If I Opt Out of Medicare Part B Will I Be Penalized if I Need It Again

If you are newly eligible for Medicare and don't enroll in Part B, you may have to pay the Function B late enrollment penalty. This penalty results in a college premium every month. Unfortunately, it also lasts every bit long every bit you take Part B.

What is the Penalty for Non Taking Medicare Part B?

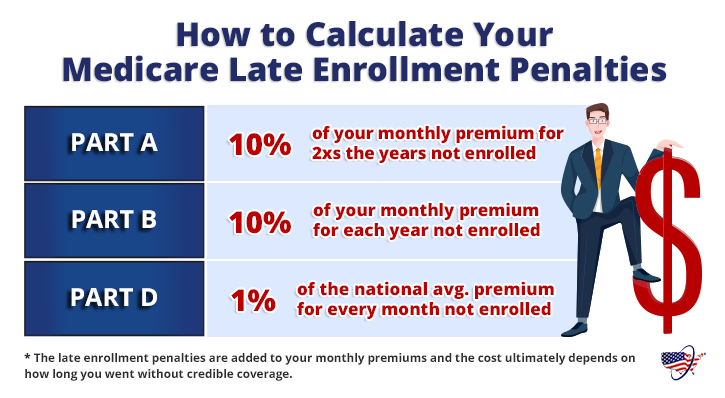

The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you lot were eligible to enroll merely didn't. The penalization is based on the standard Part B premium, regardless of the premium amount you actually pay.

Hither Are some examples of how the penalty works:

- Suppose your IEP ended on Nov thirty, merely you waited and signed upward on January 25, during the next General Enrollment Period. Because y'all didn't let an entire 12-month menses go by before the effective appointment of July 1, you lot will not pay the punishment.

- If your IEP ended on December thirty, 2013, just you did non sign upward for Part B until March 31, 2017, you would exist subject to a thirty% penalty in addition to your premium each calendar month. You waited 40 months, or three years and five months, to enroll, and so this counts as three full 12-month periods.

![]() Mind to this Podcast Episode Now!

Mind to this Podcast Episode Now!

How Can I Avoid the Medicare Part B Penalty?

If yous're turning 65, yous tin can enroll in Part B during your Initial Enrollment Catamenia. Your IEP begins on the first day of the calendar month, three months earlier your nascency month. Information technology then lasts through your birth calendar month, and ends on the last solar day of the third months following. This ways that if your 65th birthday is June fifteen, you can enroll between March one and September 30.

Suppose you don't enroll in Part B during your IEP. In that case, you usually must expect for the General Enrollment Period before you can sign up unless you're eligible for a Special Enrollment Period. Full general Enrollment runs from Jan 1 to March 31 each year.

If you lot enroll at this time, your coverage will not start until July 1. Meaning, you may exist without insurance if you have a sudden affliction or injury. You can also apply for a Medicare Savings Program to avert the Part B late enrollment penalization.

When Does the Part B Penalty Non Apply?

Those who miss the enrollment deadline but sign upwards during the adjacent General Enrollment Menstruation won't pay the penalty if less than 12 months have passed. So, if the Initial Enrollment Menstruum ends on Novmeber thirty, but viii months will accept passed earlier their Role B becomes constructive on July one.

Likewise, those under age 65 with Medicare due to disability who are paying a Part B late enrollment penalisation won't pay the penalty later on turning 65. Farther, those with Medicaid won't worry about Part B premiums and penalties because their state will comprehend those costs.

Finally, anyone living outside the United states of america who doesn't receive premium-free Part A tin can't enroll in Office A or Function B abroad. However, these people will get a Special Enrollment Menstruation for three months after returning to the United states of america.

Enrolling during those 3 months means you're non liable for tardily penalties. You may also be able to qualify for equitable relief if a federal employee told yous that you lot didn't need to sign up for Part B when yous were supposed to enroll.

How Practice I Appeal the Medicare Part B Penalty?

If you experience that the Part B penalty shouldn't utilize to your electric current state of affairs, ask for a review. Medicare has reconsideration request forms to file an appeal. Unfortunately, you'll even so take to pay the penalty while waiting for your review to be processed.

Is There a Cap on the Medicare Part B Penalty?

As of now, there is no cap on the Part B late enrollment penalty. Even so, if passed, the Medicare Office B Fairness Act or H.R.1788 would cap the penalisation amount at fifteen% of the electric current premium, regardless of how many 12-month periods the beneficiary goes without coverage. As of now, this bill is still under review, but this content volition reflect future updates in the procedure.

What if I Don't Sign Up for Part B Considering I Accept Other Health Insurance?

If you have health insurance that is creditable for Medicare through your employer, your spouse's employer, or a matrimony, yous can keep your coverage. You lot will non have to pay the penalty for waiting to sign upward for Part B. However, if your coverage is not creditable, or if you lose your coverage (voluntarily or involuntarily) the clock begins to tick.

Usually, y'all will exist allowed to sign up for Role B right away, during a Special Enrollment Period. This is an eight-calendar month window beginning when the employment coverage ends. If you practice non enroll during this period, you will have to pay a Part B penalisation for each full 12 months you lot wait beyond the appointment the SEP began.

Take Bob'due south case, for example. Bob continued working until he was 70, and then he took Medicare Part A because it is premium-complimentary and he assumed his group coverage through his employer would stand up in for Medicare Function B until he retired.

However, he did non know that considering his employer had fewer than 20 employees, his grouping coverage was non creditable for Medicare Part B. This resulted in Bob needing to pay the Medicare Office B penalty, adding 50% of the premium cost to his existing premium each month.

Because the Medicare Function B penalization is 10% in addition to your premium for each 12-month period you delay coverage, Bob needs to pay 1.v times the premium he would otherwise demand to pay, throwing off his whole budget for retirement. Additionally, the penalisation will last for as long equally Bob has Medicare Part B coverage. Picket the video beneath for Bob'due south whole story.

If y'all retire before age 65 and choose to extend your coverage using COBRA, you lot must end COBRA coverage once you are eligible for Medicare. COBRA is non creditable coverage to avert the penalty if you filibuster Part B.

- Was this article helpful ?

- Aye (99)No

How to Avert the Medicare Part B Late Enrollment Penalization

The best way to avoid Part B penalties is to plan alee. You have several Medicare options from which to cull, including Medicare Advantage or a Medicare Supplement plan.

MedicareFAQ can help you through these decisions past answering your questions and helping you prepare for Medicare. Phone call the number above or fill up out our online charge per unit form to see all the options available in your area.

Enter your zip code to pull plan options available in your expanse.

Select which Medicare plans you would like to compare in your area.

Compare rates side by side with plans & carriers available in your area.

Source: https://www.medicarefaq.com/faqs/medicare-part-b-late-enrollment-penalty/

0 Response to "If I Opt Out of Medicare Part B Will I Be Penalized if I Need It Again"

Post a Comment